how does doordash report to irs

If your store is on Marketplace Facilitator DoorDash. Technically both employees and independent contractors are on the hook for these.

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button.

. This reports your total Doordash earnings last year. You will receive your 1099 form by the end of January. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

You will be provided with a 1099-NEC form by Doordash once you start working with them. The form includes a detailed breakdown of a drivers income and what they must report on the taxes. March 31 -- E-File 1099-K forms with the IRS via FIRE.

But if filing electronically the deadline is March 31st. You will not be compensated for working for DoorDash. However all drivers are given a 1099 so that they will be aware at the end the tax year.

January 31 -- Send 1099 form to recipients. Youll get a form from Doordashs partners Stripe and Payable. February 28 -- Mail 1099-K forms to the IRS.

Most DoorDash drivers are able to do part-time deliveries and remain on unemployment. You do not have to report your door dash earnings in the unemployment office. At the end of every quarter add up your income for the quarter and pay at least 25 of that online to the govt.

Therefore the safe thing to do is always to follow the rules and report any income that you receive to avoid accusations of fraud repayments and penalties. The requirement to receive this form is if you earned more than 600 in the tax year for your services youâll be sent a 1099-NEC form. Tough to decipher the exact question youre asking but.

You just have to fill out a W-4 form if you are self-employed and report that part of your earnings. How does DoorDash report to IRS. Internal Revenue Service IRS and if required state tax.

DoorDash uses Stripe to process their payments and tax returns. Nonetheless it claims that you may. How Do Food Delivery Couriers Pay Taxes Get It Back Does Doordash Track Miles How Mileage Tracking Works For Dashers Doordash 1099 Critical Doordash Tax Information For 2022.

Regardless of whether Doordash shares your income directly it will certainly be reported to the IRS eventually and your unemployment office will find out. I was told by a fellow Dasher that at the end of the year DD will send you your 1099 mileage driven but he said to multiply it by 2 because theyre figures are usually off because it does not take into account your mileage tofrom home. In order to convey the original authors tone you also need to provide the context.

However you may be asked to report unemployment payments after you have filed your taxes. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare. Yes the payouts of this company are noted to an official unemployment branch but only if a certain amount is reached.

The forms are filed with the US. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. You should report your total doordash earnings first.

As such it looks a little different. In the next screen choose the desired tax year. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. FICA stands for Federal Income Insurance Contributions Act. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

If youre a Dasher youll need this form to file your taxes. The bill though is a lot steeper for independent contractors. How does doordash report to irs Sunday July 24 2022 Edit.

Pull out the menu on the left side of the screen and tap on Taxes. Box 7 Nonemployee Compensation will be the most important box to fill out on this form. A 1099 form differs from a W-2 which is the standard form issued to employees.

In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC. Internal Revenue Service IRS and if required state tax departments. You do not get quarterly earnings reports from dd.

Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes. Log into your checking account every pay day and put at least 25 of your dd earnings in savings. If Dashing is a small portion of your income you may be.

But if filing electronically the deadline is March 31st. Doordash will send you a 1099-NEC form to report income you made working with the company. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

If you overpaid at the end of the year you will get some money. Nonetheless at the end of the fiscal year it issues a 1099 form to each driver. Tap or click to download the 1099 form.

Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. All DoorDash payments may not be reported to the unemployment office. How does DoorDash report to IRS.

How Do Food Delivery Couriers Pay Taxes Get It Back

How Do Food Delivery Couriers Pay Taxes Get It Back

Deliver Your 1099 Tax Forms Stripe Documentation

How Do Food Delivery Couriers Pay Taxes Get It Back

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

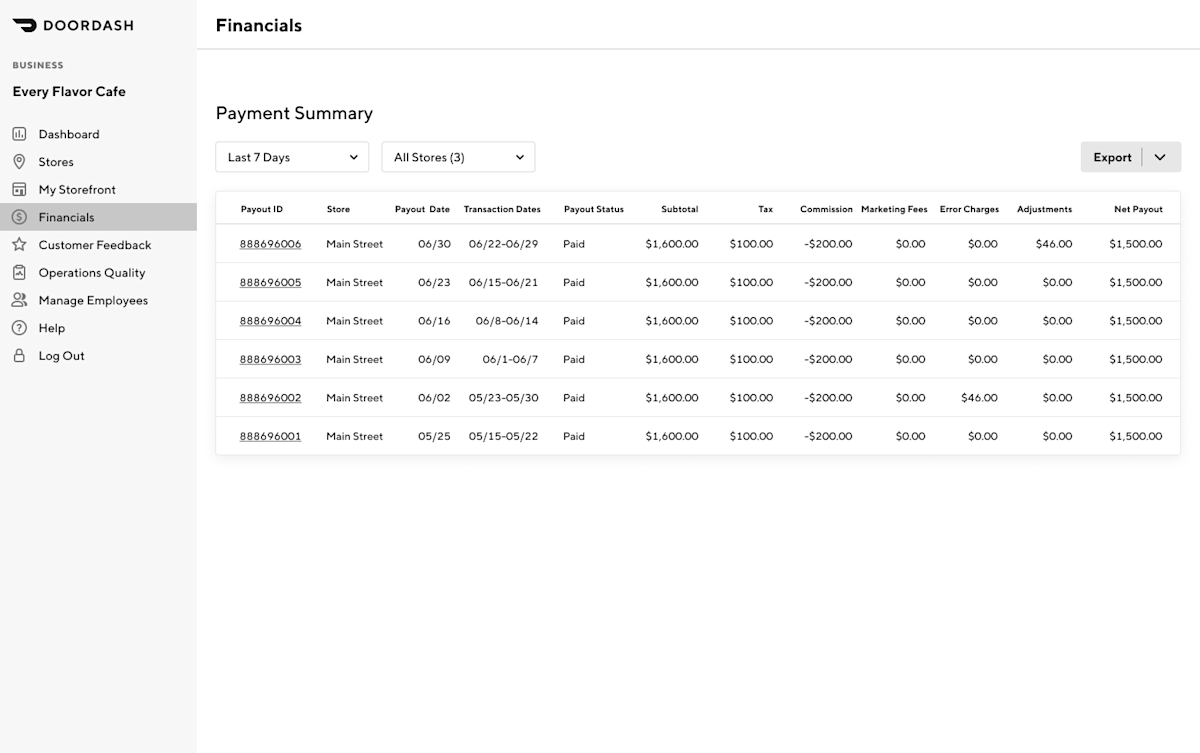

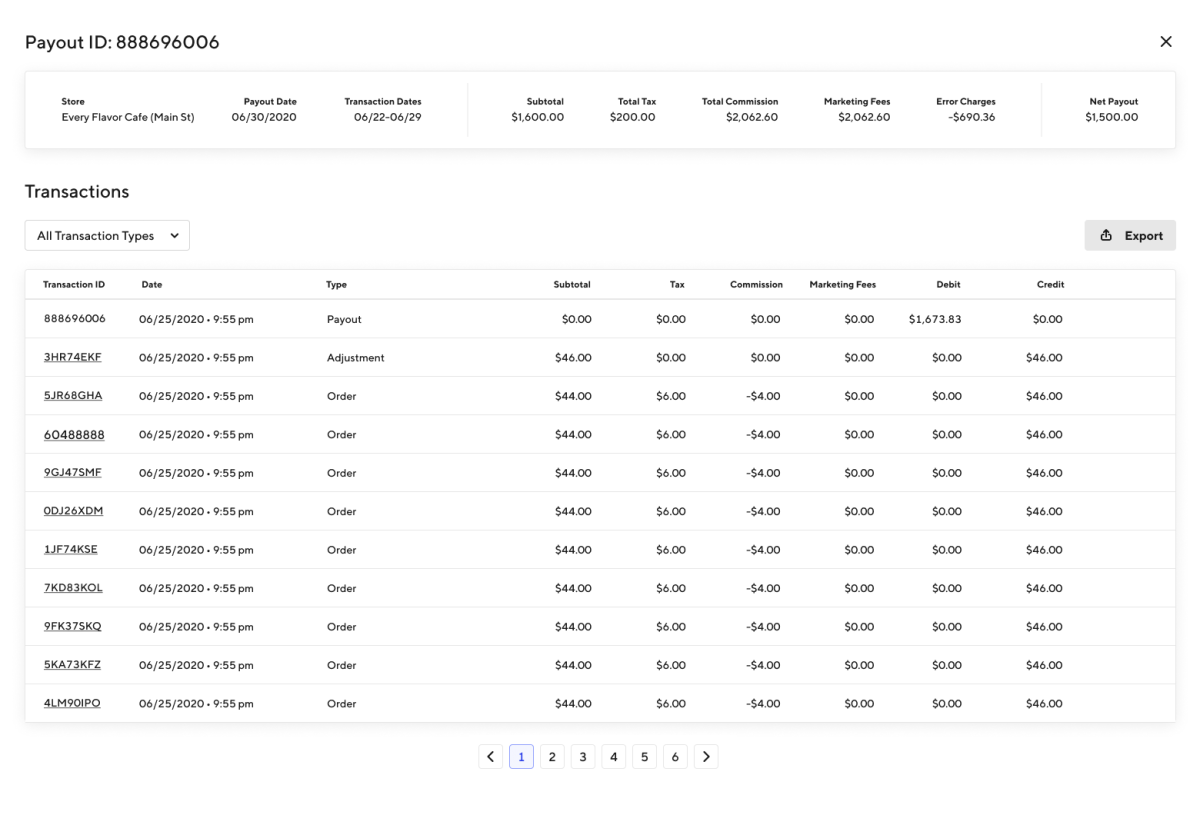

Prepare For Tax Season With These Restaurant Tax Tips

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do Food Delivery Couriers Pay Taxes Get It Back

Santander Collections Reported Cfpb Complaint How To Diy Credit Repair Dispute Letters Tutorial Credit Repair Lettering Tutorial Dispute Credit Report

Does Doordash Track Miles How Mileage Tracking Works For Dashers

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Prepare For Tax Season With These Restaurant Tax Tips

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash 1099 Critical Doordash Tax Information For 2022

Prepare For Tax Season With These Restaurant Tax Tips

Mileage Report What S Required How Falcon Expenses Can Help Mileage Tracking Mileage Expensive